(In this post, I discuss Instant Runoff, things I’ve discovered about this voting system, and my proposal for a better option. Scroll down to the example ballot to cut to the details of my one-ballot rating system.)

Despite many complaints, and the malfunctions that can be expected, many people in the year 2020 want to give Ranked Choice / Instant Runoff Voting a try. So I decided to find out if I might offer the people a better ranking system.

In seeking to make the system accurately reflect the will of the voters, I realized the core problem is:

Instant Runoff is a vote-for-1 system.

Ranking candidates makes people feel better, but only one vote at a time is counted from each voter. This insufficient use of data sometimes causes the elimination sequence to not make sense.

IRV Malfunction Example

Bush 37% 1st, 14% 2nd choice votes

Clinton 42% 1st, 5% 2nd

Perot 21% 1st, 56% 2nd

Left blank 25% of 2nd choice

IRV eliminates Perot first, it’s not even close.

IRV winner: Bush 51%.

This is arguably better than a basic vote-for-1, in which the spoiler effect would elect Clinton.

But who is really most popular?

Check Condorcet:

Bush:Clinton 51:42 – Bush

Bush:Perot 37:49 – Perot

Clinton:Perot 47:49 – Perot

Perot is the Condorcet winner, because he is preferred over the other candidates in head-to-head matchups.

Check who didn’t vote for them:

Bush 49% (51% voted for him.)

Clinton 53% (47% voted for him.)

Perot 23% (77% voted for him.)

Again, IRV eliminated Perot before the final two, even though he would beat Bush and Clinton in the final two.

In a similar dysfunctional way, IRV could eliminate the voters’ overall favorite candidate before the top four or five. Counting only one vote per ballot is Instant Runoff’s greatest weakness.

– –

So I tried adding different features to Instant Runoff. I wanted to make the system use more data from each voter.

One of my better ideas was counting two votes at a time, either counting every 1st and 2nd choice in one round, or using each ballot’s two highest-ranked qualifiers in multiple rounds.

For example, the procedure could be:

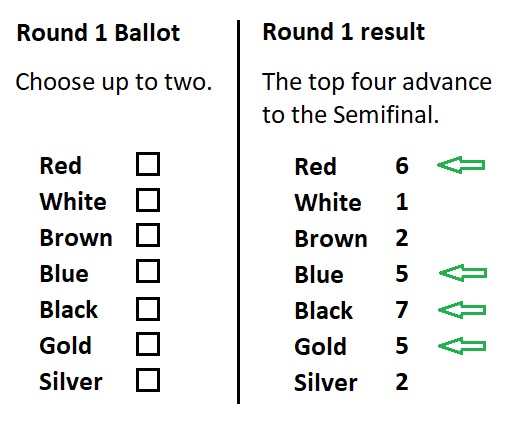

1. Count 1st choice votes, a candidate over 50% wins.

2. Narrow the field to the 4 candidates having the most 1st+2nd choice votes. (That’s vote-for-two. Would make a nice primary.)

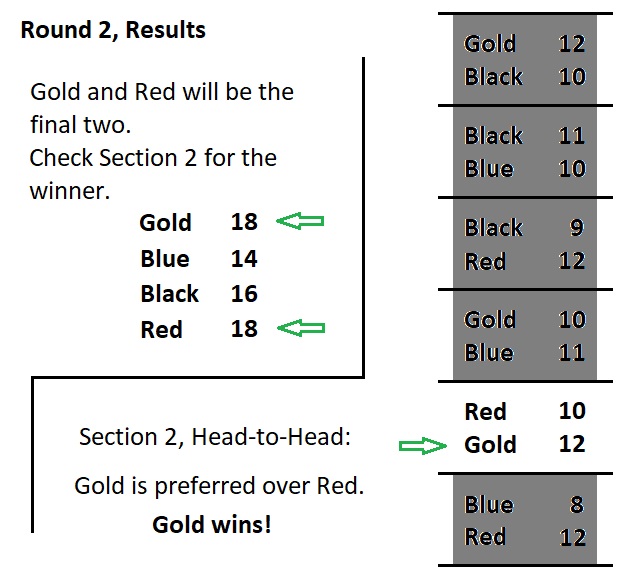

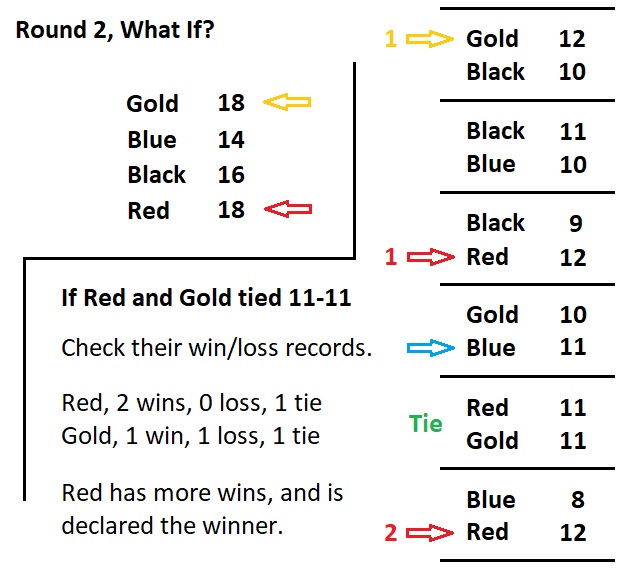

3. Narrow the field to 2 candidates by counting the votes for every voter’s two highest qualifiers. (That’s counting up to 2 votes from each ballot.)

4. Relative rankings on each ballot determine the winner. (That’s 1 vote per voter who ranked either finalist.)

Then I thought maybe a person’s three highest-ranked qualifiers could work if there are many candidates, or count everyone’s 1st, 2nd, and 3rd choices.

Then it seemed right to make a third choice worth less, maybe a half vote.

Then I realized I was making a Scoring system, a more precise way of analyzing voter preferences.

Scoring systems are easier to count and recount than Instant Runoff.

Scoring allows an opinion to be expressed about every candidate. IRV does not.

Scoring allows us to rate two candidates as the same. IRV does not.

When IRV would shut him out, Scoring could help a very popular 3rd candidate who was just a little short on 1st choice votes.

Scoring considers the 2nd preferences of the voters whose 1st choices are in the Top 2. Instant Runoff ignores that information.

Final decision on Ranked Choice / Instant Runoff:

It can work well for finding the better of two candidates, and that’s about all it’s good for.

A good Score voting system will be much better than IRV. (It will also spare me from trying to explain why vote-for-2 makes so much sense. It just does.)

So here’s my suggestion for gathering the most data, and finding the right winner, if it must be an easy-to-understand, one-ballot election.

(Thanks to the people who created STAR voting, who did a lot of the work for me.)

Example ballot:

MALOLEY’S RATING SYSTEM

with point values 4-3-2-0,

Ranked Top 2 runoff,

and Worst-candidate disqualification:

All candidates can be assigned a rating, all ratings can be used multiple times, except “Worst” can be used only once.

Voters can select from three different ratings for favorable candidates. Each rating has a corresponding point value for determining the finalists (Top 2), and a rank, for determining which of the final two candidates is more popular.

Voters should give a favorable rating only to candidates they want to win. The favorable ratings are:

– Excellent, 4 points

– Good, 3 points

– OK (Acceptable), 2 points

Voters can also rank candidates of whom they do not approve, without giving them any points. This allows voters who dislike both of the Top 2 candidates to choose between them.

The unfavorable (don’t want to win) rankings are, from high to low:

– Neutral, 0 points (mild dislike, unknown, or not marked)

– Bad, 0 points

– Worst, 0 points (Limit one Worst vote per ballot)

“Worst” indicates a special disapproval, the sole candidate that the voter wants to lose to every other candidate.

A rank of “Worst,” given to one candidate by more than half the voters (a true majority) will eliminate the candidate, regardless of score.

Procedure:

1. A candidate who has “Worst” votes from more than half of the voters will be disqualified.

2. Point totals qualify the two highest-scoring candidates (but not a disqualified one) for the Top 2 runoff.

3. Rank on each ballot determines which of the Top 2 is preferred by more voters, and is therefore the winner.

One last note on step 3, the Top 2 runoff: This is to guarantee the winner is the more popular of the top two. The runoff uses the ranking of candidates on each ballot, so it would require the same equipment or programming necessary for Instant Runoff. Without that capability, the Top 2 would have to be dropped, “Bad” and “Neutral” would be merged into one rating, and the winner would be the one with the highest score, which will almost always be the most popular candidate anyway.

Or, use a primary to narrow the field to 3 or 4, and use Head-to-head matches for the Top 2 instead of ranking. Without the primary, there could be too many candidates to list all the possible combinations. Click this link for the article on Head-to-head matches. https://americarepair.home.blog/2020/01/17/head-to-head-matches-make-a-better-instant-runoff/